From November 1st 2024, the minimum wage for Public Sector workers will be increased, from $20.50 per hour to $22.50 per hour.

This announcement came from Finance Minister Colm Imbert, during a marathon Budget Presentation that lasted just over 5 hours and 10 minutes.

Mr Imbert clarified this is for Public Sector workers ONLY and is not an increase in the National Minimum Wage.

The Minister also spoke about wage negotiations, outlining an offer of a 5% increase to public sector workers for the period 2020 to 2022.

He added that there will be back-pay for public sector workers at the end of 2022 if new agreements are met.

In terms of other key announcements, Mr Imbert said another Tax and NIS Amnesty from October 1st to December 31st 2024, for persons to pay outstanding taxes without penalties or interest.

Also announced:

- All electric vehicle charging equipment and accessories will be exempt from taxes and duties in 2025.

- From January 1st 2025, the all sporting equipment will be exempt from taxes and duty, with the exception of clothing.

- A review of all items used in agriculture will be done, with an aim to make the industry truly tax-free.

- $3.5 million will be spent to create a CSEC Remedial Mathematics programme at 26 schools to deal with the declining student performance in this subject.

The 2024/2025 Budget estimated revenue at $54.224 billion, with expenditure set at $59.741 billion.

This means a deficit of about $5.517 billion.

The Natural Gas assumption at US$3.59 per mmbtu, while the oil price assumption is US$77.80 per barrel.

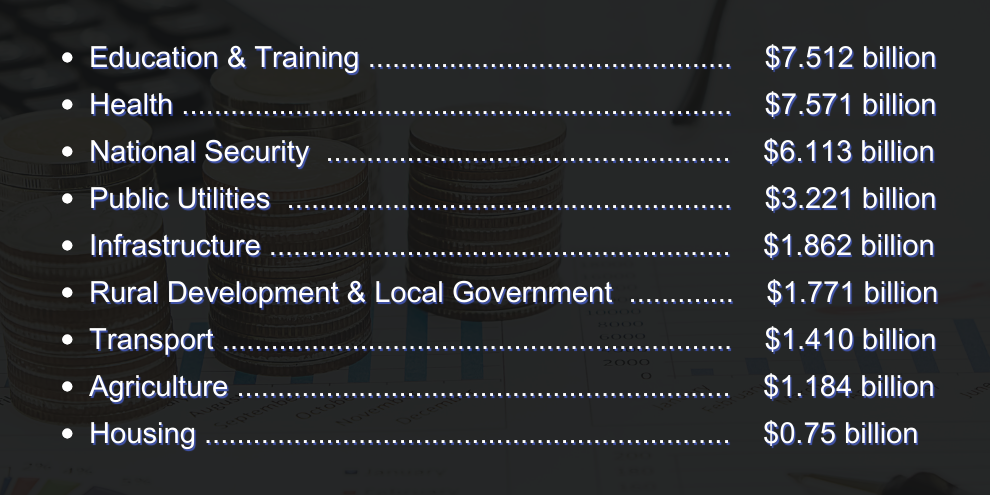

Allocations are as follows:

Meanwhile, Mr Imbert revealed that the Immigration Division has been authorized to begin conversion from machine readable passports to e-passorts.

He said this, along with automated border control gates, will allow smoother travel across borders with increased security measures.

On the matter of crime management and National Security, he said Government will purchase 4 patrol ships and 8 high speed interceptors for border control, as well as 2 fixed-wing aircraft and unmanned drones for search and rescue and surveillance.

An automated fingerprint ID system will be implemented at ports of entry to strengthen border management for faster and more accurate fingerprint matching to monitor travelers.

2,000 police vehicles will also be acquired over the next three years, with 500 to come in the first phase.

The TTPS will also purchase body cameras for officers, and additional speed guns.

With regard to Property Tax, Mr Imbert said 89,441 residential property owners have so far paid taxes amounting to $91M in revenue.

He said this, along with property tax collected in fiscal 2025, will be distributed to Local Government bodies in Fiscal 2025.

More revenue is also expected in the next year, following the full proclamation of the Gambling Act in 2025.

Additionally, he revealed that $210 million to be spent by the Works Ministry next year on 100 new projects across all areas of Trinidad, and that Government is targeting 30% of energy needs to come from renewable energy by 2025.

The Minister also assured that Food Security remains a top priority, with 2025 to focus on improving agriculture infrastructure such as road & water management systems and fisheries infrastructure.

Mr Imbert meanwhile is optimistic about the performance of the local economy.

In 2024, he said growth is expected to be at to 1.9%, which means there would have been three consecutive years of real growth.

According to the Minister, this signifies a renewal of economic activity.

He also anticipates growth in non-energy sector with a 2.4% rise in non-oil sector expected to drive the growth in GDP.

With regard to forex, the Minister said Foreign Reserves are at 5.5 billion US dollars, while the Heritage and Stabalization Fund is at 6.1 billion USD.

To bolster reserves, he said in 2025, Government plans to introduce legislation to make all Energy taxes be paid via US dollars.

Meanwhile, Mr Imbert sought to dispel fears that the T&T Revenue Authority would go after small business, such as street vendors.

He assured that this will not be the case, and also insisted that T&T will not seek financing from the IMF.

With regard to health care, he said the Central Block at the Port of Spain General Hospital is about 60% completed, and expected to be open by March 2025.

There was also the assurance that significant funds will be allocated for the construction and renovation of hospitals, as well as the purchase of medical equipment.

Responses